Amsilk: Millions for production expansion

The biotech company Amsilk, which specialises in the production of spider silk proteins, has raised tens of millions in fresh capital in a financing round to expand production of the high-tech biomaterial.

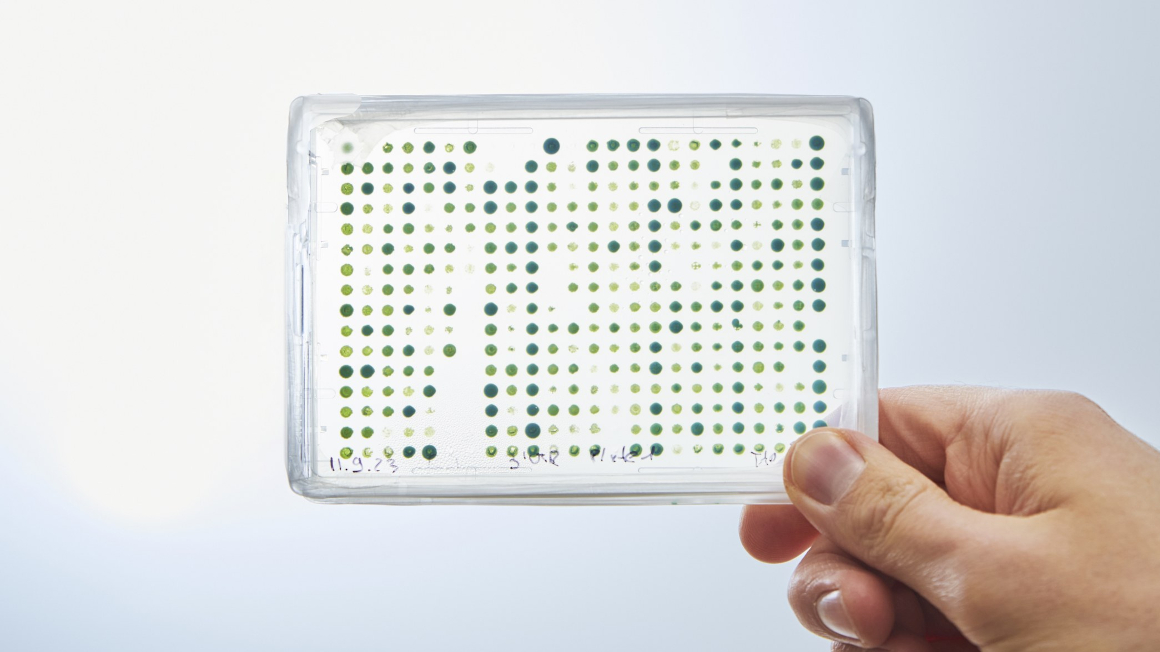

Amsilk GmbH, based in Neuried, is considered a pioneer in industrial biotechnology. The team has developed a method in which microorganisms produce modified silk proteins. These can be further processed into powders, hydrogels, fibres and coatings. The biomaterials produced from these consist of 100% silk proteins and are completely biodegradable.

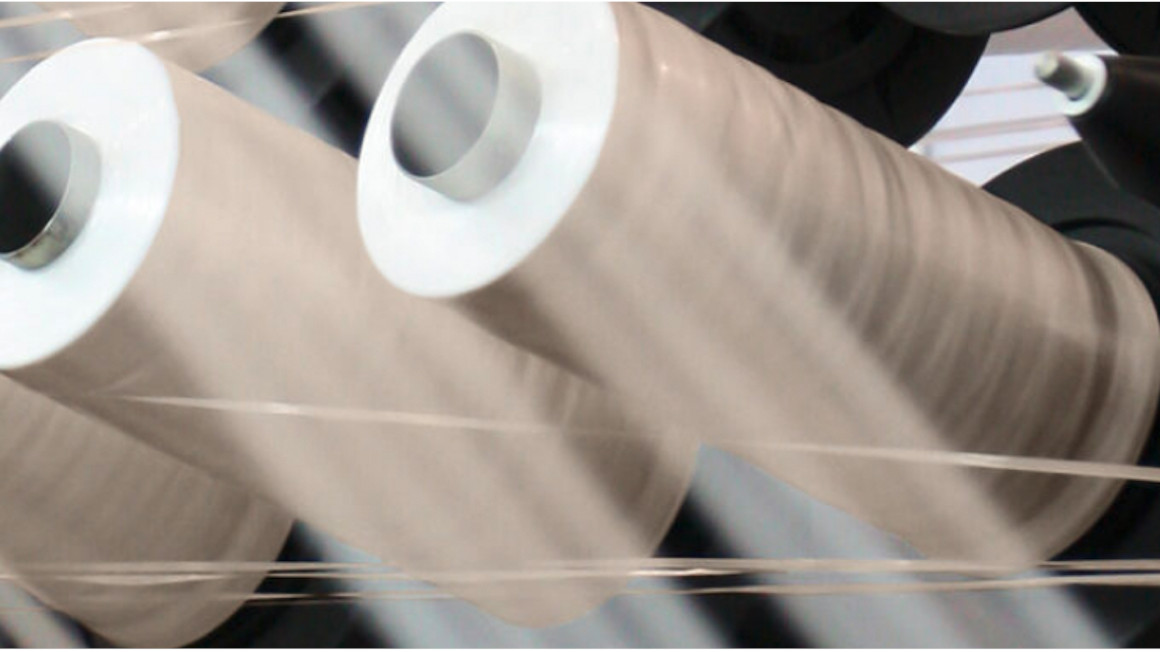

In 2013, the Munich-based company produced the first fibres from this material. Today, the artificial spider silk threads, called Biosteel, are used in numerous high-tech products such as running shoes, watch straps, door handle loops and aircraft wings. Spider silk proteins are also used in medicine and cosmetics.

52 million euros for expansion and scaling

In a recent financing round, Amsilk was once again able to raise 52 million euros from investors. ‘The investment underscores the confidence in our clear market access, our scalable technology and our strong partner network,’ said Ralph Fraundorfer, Chief Financial Officer of Amsilk. According to Amsilk, it intends to use the fresh capital ‘to further drive commercial expansion’ and ‘support the next phase of industrial scaling’ in order to ‘meet the growing global demand for its silk-based protein materials’.

Building an industry for high-performance biotech materials

‘Thanks to the funding committed by our investors, we can now work with our partners to massively increase production,’ says Wolfgang Colberg, Chairman of the Amsilk Advisory Board. This is a significant step towards building a completely new industry in Europe and worldwide for high-performance biotech materials that can be used in countless applications.

In addition to existing investor ATHOS, MIG Capital and Novo Holdings played a decisive role in the financing round. The financing combines €30 million in equity with €22 million in convertible bonds.

bb