Investments in the market for alternative proteins on the rise

German companies that produce meat and dairy alternatives based on plants, fermentation and cell cultures were able to raise a total of EUR 74 million in the first half of 2024, more than twice as much capital as in the whole of 2023.

In light of a growing population and dwindling resources due to climate change, alternative protein sources for the production of new foods are becoming increasingly important. Their range is broad: legumes, algae, fungi and insects as well as proteins obtained through cell-based or fermentative processes are suitable as raw material sources for a healthy, environmentally conscious and sustainable diet. The development of innovative foods based on alternative proteins has also become attractive to investors.

Investments in German companies have risen significantly

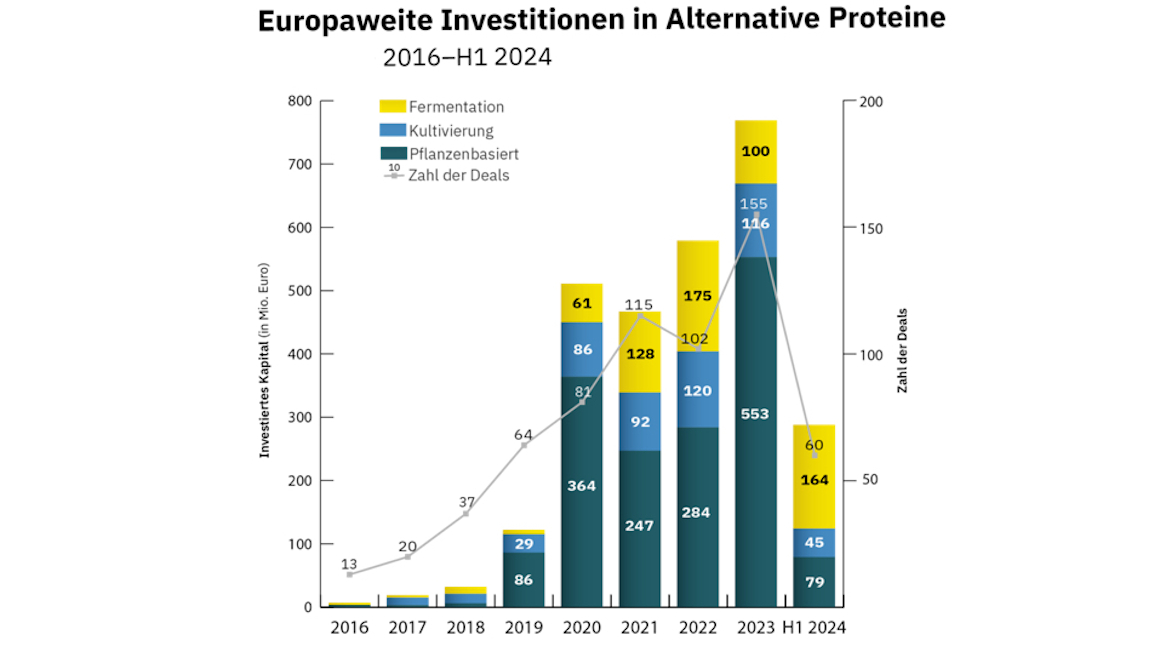

According to the Good Food Institute Europe (GFI), European companies that produce meat and dairy alternatives based on plants, fermentation and cell cultivation were able to attract investments totaling EUR 289 million in the first half of 2024. At a total of EUR 74 million, more than twice as much venture capital was invested in German companies alone as in the whole of 2023. In the previous year, investments amounted to EUR 28 million.

In the past year, however, the sector in Germany has grown less through venture capital and more through investments and partnerships from established industrial and food companies, according to the report. A major investment of over 100 million euros by Nordzucker is cited as an example. According to GFI, the restrained investment activity of the past year will now be made up for by the revival of venture capital in the first months of 2024.

Carlotte Lucas, Head of Industry at GFI Europe, comments: “Venture capital has been crucial for the growth of innovative companies producing food based on plants, fermentation and cultivation. However, for the sector to make a decisive contribution to food security, sustainability and economic strength in Europe, new financing approaches and greater cooperation with established players in the food industry will also be required in the future.”

Largest investments in the fermentation sector

According to GFI, the majority of financing goes into the sector of fermentation, fermentation technology or precision fermentation. In the field of fermentation, in which microorganisms are used to produce innovative foods, European companies were able to raise investments of EUR 164 million in the first six months of 2024. This is just over half of all financing in the novel food sector and significantly more than the EUR 100 million invested in this area in 2023 as a whole. 115 million of this was invested in biomass fermentation alone - such as the production of mycoproteins using fungi - and €49 million in precision fermentation - such as the production of real egg and milk proteins using yeast.

A large proportion of European investments in the field of fermentation went to German companies. The Hamburg-based biotech start-up Infinite Roots raised 53 million euros and ProteinDistillery from Ostfildern 15 million euros. Both companies use biomass fermentation to obtain mycoproteins for the production of sustainable food and utilize side streams from the food industry, including from beer brewing. According to GFI, many of the companies active in the field of fermentation are using the money to drive forward the scaling and development of infrastructure.

According to the GFI survey, investments in cultured meat, which is produced from animal cells in bioreactors, amounted to EUR 45 million in Europe in the first half of 2024, which is slightly less than half of the EUR 106 million for the whole of 2023. This was dominated by investments of EUR 40 million in the Dutch company Mosa Meat alone. Among others, the German PHW Group was involved in this. Smaller investments of over EUR 3 million were made in Innocent Meat from Rostock, which is working on complete solutions for meat cultures, and EUR 2.3 million in Cultimate Foods, which produces cultured fats as an ingredient for hybrid products.

Public investment required

“The first signs of a positive turnaround in private investment in Germany should not obscure the fact that the sector is structurally underfunded and also needs public investment,” says Ivo Rzegotta, Senior Public Affairs Manager at GFI Europe. His demand: “Politicians in Germany have already invested in the protein turnaround, but this must be expanded further.”

According to the Federal Ministry of Agriculture, Germany is investing a total of 88 million euros in alternative protein sources for human nutrition by 2023. At the beginning of this year, the German parliament also decided as part of its budget deliberations to invest more than 30 million euros in conversion aid for farmers and in innovation funding to further support the protein transition.

The GFI survey analyzed data from Net Zero Insights, which records all companies working on alternative protein sources. When interpreting the figures, it should be noted that investment activity in 2023 - due to economic uncertainty and rising inflation - has declined in all sectors and therefore reflects the general trend due to the tense situation on the global markets.

bb/gkä