Bioplastics industry grapples with ignorant consumers

EU consumers have minor knowledge on bioplastics but unrealistically high expectations that can not be fulfilled, researchers said at 11th European Bioplastics Conference in Berlin.

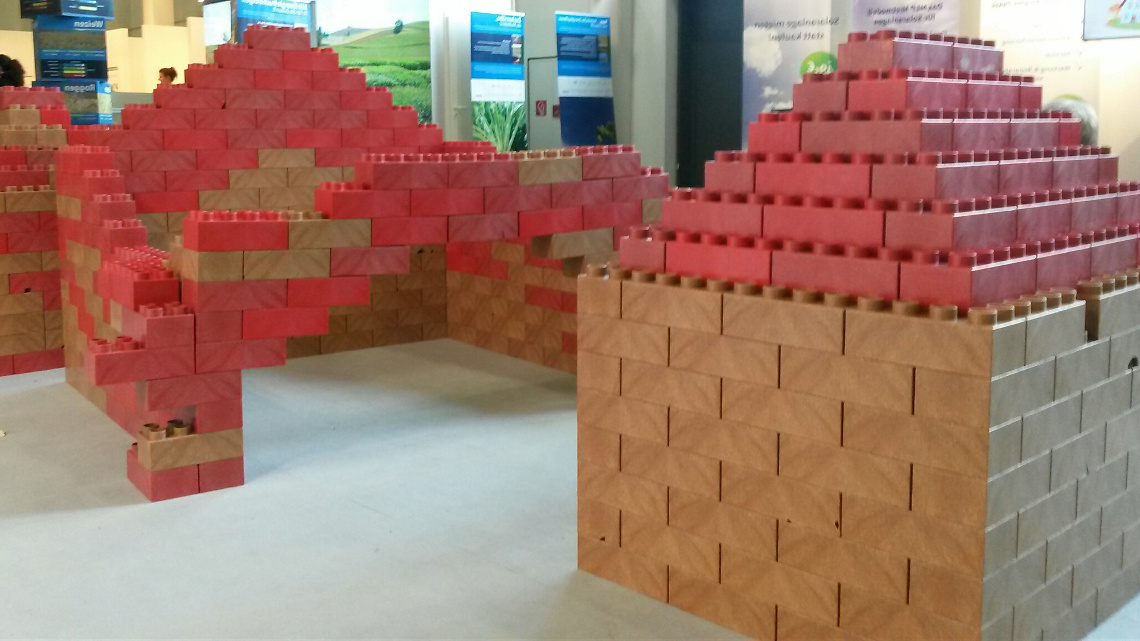

Experts from industry expect the global bioplastics production capacity to increase from around 4.2 million tonnes in 2016 to 6.1 million tonnes in 2021, mainly in consumer goods and applications in the transport sector. “The market is predicted to grow by 50% over the coming years despite the low oil price,” says François de Bie, Chairman of European Bioplastics at the 11th European Bioplastics Conference in Berlin.

Lack of public awareness and acceptance, however, could hamper uptake of bioplastics at the consumer level. According to a survey of more than 1.700 consumers, most of them have incomplete knowledge of what bioplastics are as well as what they can do. “Most consumers have unrealistically high expectations in the sustainability of bioplastics,” study author Julia Marie Blesen said to the approximately 350 visitors.

According to the survey, only 36.3% had ever heard of bioplastics while 56.7% of consumers said they have never heard of bioplastics before. However, the 7.1% of pollees, who claimed to have detailed knowledge of bioplastics 66.9% characterised them as biodegradable (about 25% of current bioplastics or 964,000 tonnes, are biodegradable), and 39% said they were bio-based (about 75% are bio-based and non-biodegradable). On the other hand, they expected bioplastics to be non-toxic and environmentally-friendly. At the same time, there seems to be deep mistrust as consumers claimed the industry to use the terminus bio-based for green-washing. The study author recommended to create more awareness and transparency about the existing advantages of bioplastics to prevent dissatisfaction of consumers whose expectations wouldn’t be met.

“Industry is in a difficult situation as bioplastics are complex and it’s hard to communicate all pro and cons of the very different bioplastics in an appropriate way”, European Bioplastics’ head Hasso von Pogrell told European Biotechnology. In fact, bioplastics are an emergent sector. Bio-based (that is plastics made from biomass which have an improved CO2 footprint over conventional plastics), non-biodegradable plastics, such as polyurethanes (PUR) and drop-in solutions, such as bio-based PE and bio-based PET, are the main drivers of this growth, with PUR making up around 40% and PET over 20% of the global bioplastics production capacities. More than 75% of the bioplastics production capacity worldwide in 2016 was bio-based, durable plastics. This share will increase to almost 80%in 2021. Production capacities of biodegradable plastics, such as PLA, PHA, and starch blends (which could contribute to improved recycling), are also growing but with a slower dynamics from around 0.9 million tonnes in 2016 to almost 1.3 million tonnes in 2021. Increased awareness of the pro and cons of bioplastics can support novel approaches for plastics recycling and production to reach the market.